Introducing the game-changing expenses app, your ultimate solution for effortless expense tracking, budgeting, and collaboration. Dive into the world of streamlined expense management and unlock a new level of financial control.

With its intuitive interface and robust features, our expenses app empowers you to track expenses seamlessly, create and manage budgets effortlessly, and collaborate with your team efficiently. Say goodbye to the hassles of manual expense reporting and hello to a world of simplified financial management.

Expense Tracking Features

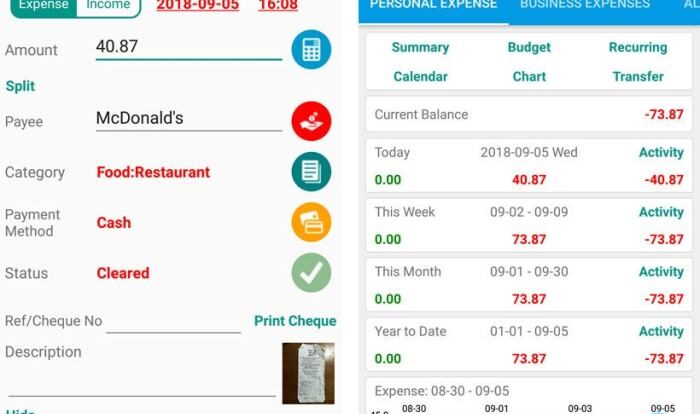

Expense tracking apps provide a convenient and efficient way to monitor and manage your spending. Here are some essential features that every expense tracking app should have:

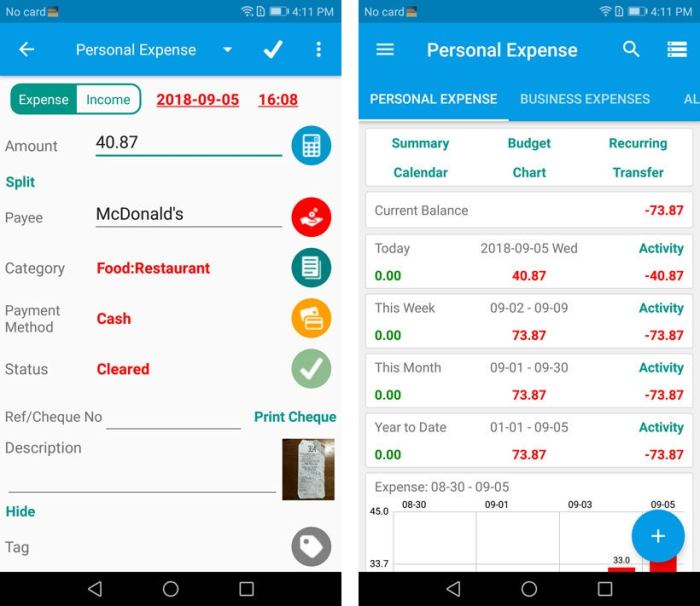

Automated Expense Categorization:This feature automatically assigns expenses to predefined categories, such as groceries, entertainment, or travel. It saves time and reduces the risk of miscategorization, ensuring accurate expense tracking.

An expenses app can help you keep track of your spending and identify areas where you can save money. If you’re looking for ways to make extra money, there are a number of legit money making apps available that can help you earn cash or rewards.

These apps can be a great way to supplement your income or reach your financial goals faster. With an expenses app, you can track your progress and see how your spending habits are affecting your ability to save money and reach your financial goals.

Receipt Scanning

Receipt scanning allows users to capture receipts using their smartphone camera. The app then extracts expense data, such as the amount, date, and merchant, from the receipt and automatically adds it to the expense log. This eliminates the need for manual data entry, reducing errors and saving time.

An expenses app can be a great way to track your spending and keep your finances organized. If you’re looking for the best receipt app to use with your expenses app, be sure to check out our article on the best receipt app.

Our article provides a comprehensive overview of the top receipt apps on the market, so you can find the one that’s right for you.

Expense Tracking Reports

Expense tracking reports provide a comprehensive overview of your spending habits. These reports can be customized to show expenses by category, time period, or other criteria. By analyzing these reports, users can identify areas where they can save money and make better financial decisions.

Budgeting and Forecasting

An expenses app can be a valuable tool for managing your finances by assisting you in creating and adhering to budgets, as well as forecasting your cash flow.

Creating a budget involves setting limits on how much you can spend in various categories, such as groceries, entertainment, and transportation. An expenses app can help you track your expenses and compare them to your budget, allowing you to identify areas where you may be overspending and make adjustments accordingly.

Cash Flow Forecasting

Cash flow forecasting is essential for understanding your financial situation and planning for the future. An expenses app can assist you in this process by providing insights into your income and expenses over time. This information can help you anticipate potential shortfalls or surpluses, enabling you to make informed decisions about saving, investing, or adjusting your spending habits.

Setting Financial Goals

An expenses app can also assist you in setting financial goals, such as saving for a down payment on a house or retiring early. By tracking your progress towards these goals, you can stay motivated and make necessary adjustments along the way.

Collaboration and Sharing: Expenses App

Expense apps empower teams with collaborative features that streamline expense management and enhance efficiency.

Expense sharing simplifies expense management for groups, allowing multiple individuals to track and allocate expenses collectively.

Streamlined Expense Reporting and Approvals, Expenses app

Businesses can leverage expense apps to automate expense reporting and approvals, reducing manual tasks and expediting reimbursement processes:

- Team members can submit expenses directly through the app, eliminating the need for paper-based or email submissions.

- Approvers can review and approve expenses on the go, ensuring timely reimbursement and reducing delays.

- Automated notifications and reminders keep team members informed of pending approvals and expenses that require attention.

Integrations and Connectivity

Seamless integration with accounting software and financial institutions is paramount for efficient expense management. It enables automatic data exchange, eliminating manual data entry errors and saving valuable time.

Mobile apps and web platforms complement each other for expense management. Mobile apps offer convenience for on-the-go expense tracking, while web platforms provide comprehensive dashboards and reporting capabilities for deeper analysis.

API Access for Custom Integrations

Expenses apps that offer API access empower users with the flexibility to integrate with custom systems and tailor the solution to their specific needs. This enables seamless data flow between different applications, eliminating data silos and enhancing operational efficiency.

Security and Data Protection

Expenses apps hold sensitive financial information, making data security paramount. They employ robust measures to safeguard user data from unauthorized access and breaches.

Encryption ensures that data is scrambled during transmission and storage, preventing unauthorized parties from accessing it. Multi-factor authentication adds an extra layer of security by requiring multiple forms of identification, such as a password and a one-time code sent to a user’s mobile device.

Compliance with Industry Standards

Expenses apps adhere to industry standards and regulations to ensure data protection. Compliance with the Payment Card Industry Data Security Standard (PCI DSS) demonstrates an app’s commitment to protecting cardholder data.

Tips for Users

- Choose an app that prioritizes security and has a proven track record.

- Use strong passwords and enable multi-factor authentication.

- Be cautious about sharing login credentials or accessing the app on public Wi-Fi.

Last Word

Harness the power of our expenses app today and transform the way you manage expenses. From automated expense categorization to real-time reporting, our app is designed to make your life easier and your finances more organized. Embrace the future of expense management and unlock the key to financial success.